De-risk Your Climate Investment

Why Insurance?

PORTFOLIO OPTIMIZATION

Increase your risk-adjusted returns. By absorbing project developer, offtaker, and country risk, insurance widens your investment universe, while ensuring your portfolio delivers consistent returns and low volatility.

CAPITAL EFFICIENCY

Ease your regulatory capital requirements. Insurance reduces your risk-weighted assets, freeing up funds and improving your risk capacity, while costing less than traditional risk mechanisms (e.g. credit default swaps).

COMPETITIVE EDGE

Elevate your market position. By enabling you to broaden your sustainable investment universe and deploy more capital, more quickly, insurance helps you attract new mandates and secure higher upfront fees.

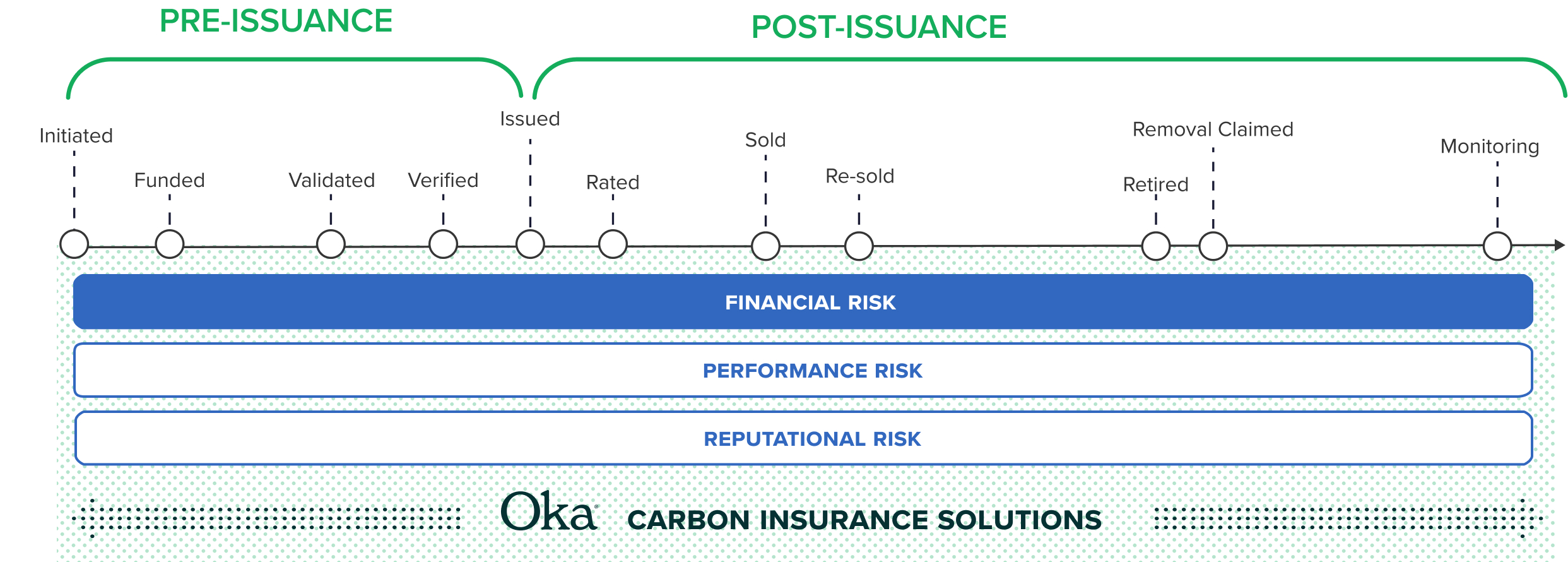

Protection Throughout the Carbon Credit Lifecycle

Partner With Oka

Oka’s team of market and insurance experts has built innovative insurance solutions for a wide range of stakeholders, at every point of the carbon credit lifecycle.

By transferring risk off the balance sheets of project developers, investors, and customers, we bring capital to carbon markets.

Financial Risk

Solution

Our financial protection solutions provide commercial lenders and project investors with financial compensation in the event that the borrower defaults on their debt obligations. Learn More >

Contract Risk Solution

Our policies can be tailored to address pre-issuance credit risks, including non-delivery under the terms of pre-payment or offtake agreements, raising the bar for contract certainty. Learn More >

Bespoke Risk Solution

Discover how a bespoke insurance solution can help you access more finance, lower project costs, and drive customer demand.

Get in Touch >

Explore Carbon Insurance Solutions

Advisory services, research, and risk assessment of your

carbon projects and investments.

"*" indicates required fields