Eliminate Risks, Accelerate Growth

Project and credit insurance eliminates the perception of risk currently hindering market growth and climate impact. Designed to meet the risk requirements of your lenders and customers, our modular solutions open the door to more finance, lower costs, and higher demand.

In addition to tailored solutions, we provide developers with RFP consulting services. Through our work with your stakeholders, we know their risk requirements and can help you design your proposals for maximum impact.

Why Insurance?

Financial Protection

Insurance minimizes your financial burden in the event that you lose or must replace credit inventory, while alleviating the ongoing cost of managing unforseeable and unavoidable risk.

Customer Access

Insurance-wrapped credits are more likely to meet stringent corporate risk requirements, while risk guarantees are also a prerequisite for selling into compliance markets. Registries are in the process of approving private insurance as a provider of that guarantee.

Premium Prices

Insurance is a quality marker, as well as a prerequisite for compliance markets, where credits sell for a premium. As a result, insurance-wrapped credits typically sell more quickly, and at a higher value.

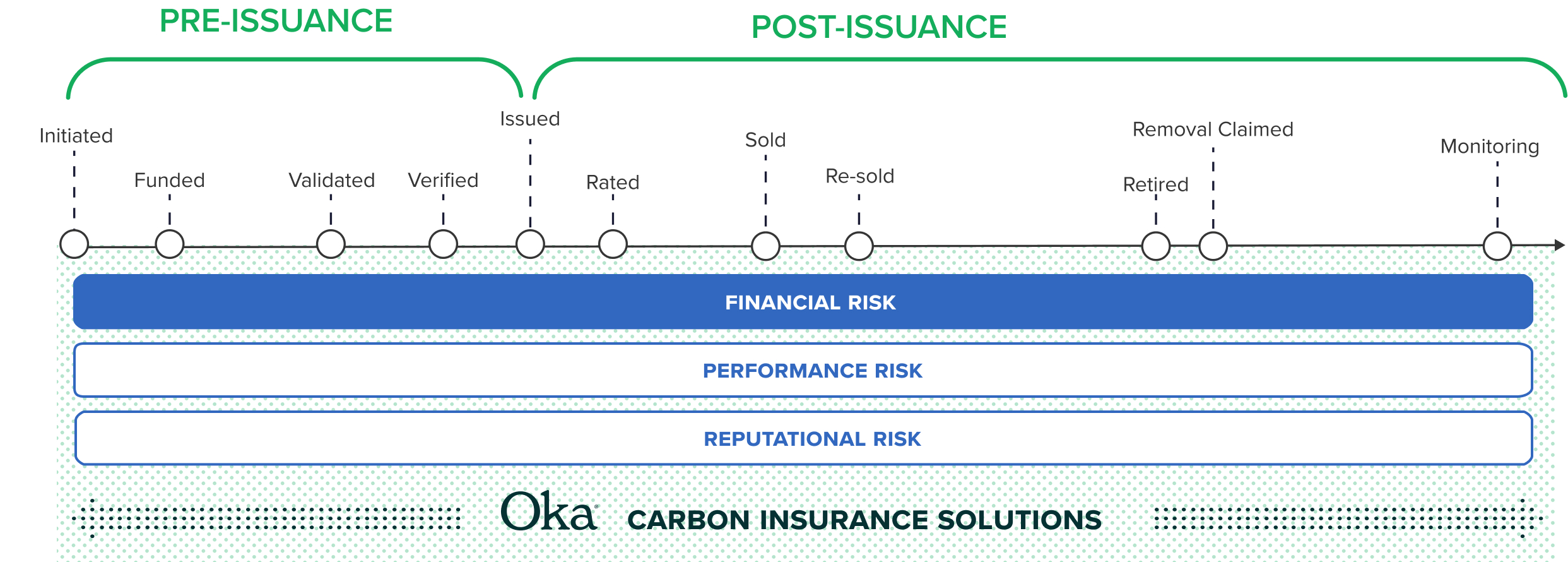

Security Through the Carbon Credit Lifecycle

Partner With Oka

Oka’s team of market and insurance experts has built innovative insurance solutions for a wide range of stakeholders, at every point of the carbon credit lifecycle.

By transferring risk off the balance sheets of project developers, investors, and customers, we bring capital to carbon markets.

Project Risk

Solution

Carbon Protect provides the credit-holder with financial compensation in the event of credit cancellation due to unforeseeable and unavoidable post-issuance risks, including invalidation or reversal. Learn More >

Country Risk Solution

Designed for voluntary credits authorized for sale into compliance markets, Corresponding Adjustment Protect provides developers with financial compensation in the event that a failed corresponding adjustment leads to credit de-authorization. Learn More >

Bespoke Risk Solution

Discover how a bespoke insurance solution can help you access more finance, lower project costs, and drive customer demand.

Get in Touch >

Explore Carbon Insurance Solutions

Advisory services, research, and risk assessment of your

carbon projects and investments.

"*" indicates required fields