Secure Your Carbon Investment

Our team of experts provides consultation services to buyers helping them identify and evaluate project risks within their carbon projects that could result in reversal or invalidation. We provide a comprehensive risk-assessment based on our deep carbon expertise and our proprietary underwriting platform.

Our insurance solutions allow buyers to transfer the risk to Oka (insurer), a specialized party with the right risk-assessment capabilities, which allows buyers to reduce balance sheet risk, meet decarbonization strategies and safeguard reputational risk.

Additionally, we offer guidance on RFP submissions equipping buyers as they negotiate offtake agreements.

Why Insurance?

Safeguard Your Investment

In the event of a pre- or post-issuance loss, our tailored insurance solutions cover the cost of the credits. The financial benefits of insurance begin even pre-purchase or peril, as it reduces your due diligence and associated time, capital, and resource costs.

Protect Your Claims

We understand the challenges you face in reaching your net-zero targets and the risks to which you are exposed when buying carbon credits. Insurance allows you to offset your emissions with confidence, insulating your portfolio and thus decarbonization claims In the event of a loss.

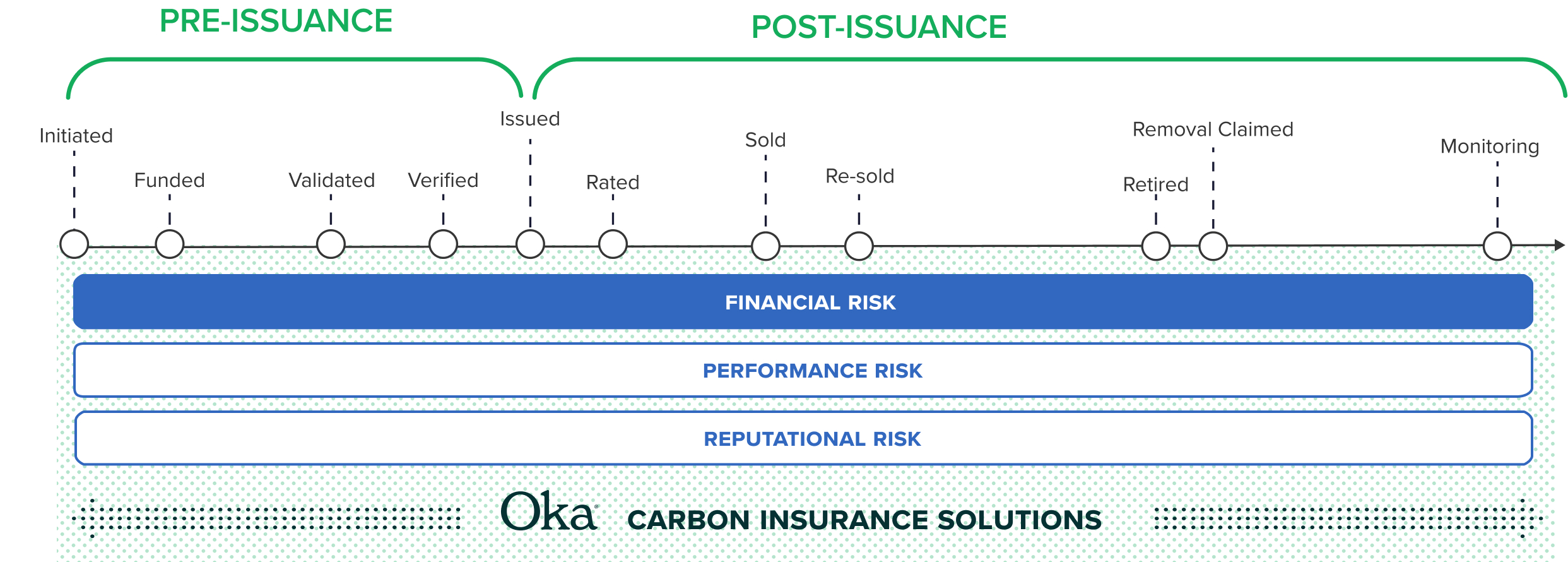

Protection Throughout the Carbon Credit Lifecycle

Partner With Oka

Oka’s team of market and insurance experts has built innovative insurance solutions for a wide range of stakeholders, at every point of the carbon credit lifecycle.

By transferring risk off the balance sheets of project developers, investors, and customers, we bring capital to carbon markets.

Contract Risk Solution

Our policies can be tailored to address pre-issuance credit risks, including non-delivery under the terms of pre-payment or offtake agreements, raising the bar for contract certainty. Learn More >

Project Risk

Solution

Carbon Protect provides the credit-holder with financial compensation in the event of credit cancellation due to unforeseeable and unavoidable post-issuance risks, including invalidation or reversal. Learn More >

Bespoke Risk Solution

Discover how a bespoke insurance solution can help you access more finance, lower project costs, and drive customer demand.

Get in Touch >

Explore Carbon Insurance Solutions

Advisory services, research, and risk assessment of your

carbon projects and investments.

"*" indicates required fields