Bruised by greenwashing allegations in 2023, nature-based REDD+ project developers — including many tarnished unfairly by sensationalist headlines — have been working overtime to tackle scepticism with evidence of integrity.

But is the evidence enough to placate risk-averse corporate buyers?

Judging by acute price declines across the market and particularly among standardized contracts, still more can and must be done to restore confidence in the voluntary carbon market (VCM). And with CORSIA introducing a tidal wave of demand, coupled with stricter guardrails for buyers, there’s more incentive than ever before to distinguish a high-quality project from an average one.

While rigorous project-level measurement, reporting, and verification (MRV) and project ratings communicate to the market that carbon-credit risks have been addressed, only carbon insurance can truly safeguard and protect public claims in the event of a loss.

1.Signal Project Quality, Command a Higher Premium

Fewer than 40% of REDD+ projects have a “high likelihood” of meeting Core Carbon Principles (CCP) criteria¹. Oka, The Carbon Insurance Company (Oka)™ takes a more granular approach, going beyond the registry and methodology to assess project integrity. As a result, a higher percentage of projects meet our insurable threshold.

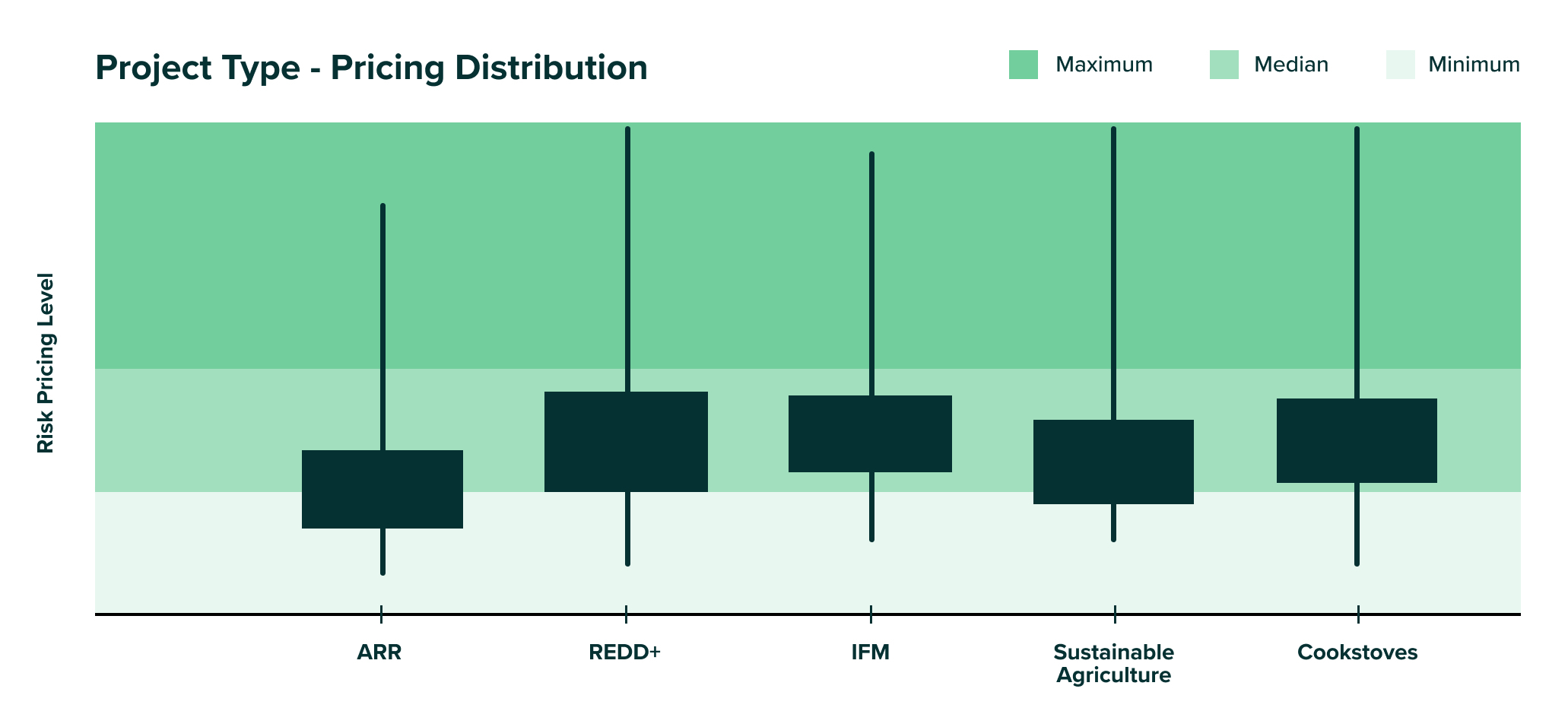

Quality — and, indeed, the price of insurance — varies significantly between different projects of the same type (Fig. 1). Insurance can help signal your project’s above-market quality to the market, so the proverbial baby doesn’t get thrown out with the bathwater of negative press.

Figure 1

Credits that send a premium signal will command a premium price. The markup associated with insurance-wrapped credits could increase your profit margins substantially.

2. Attract a Bigger Audience, Sell Credits Faster

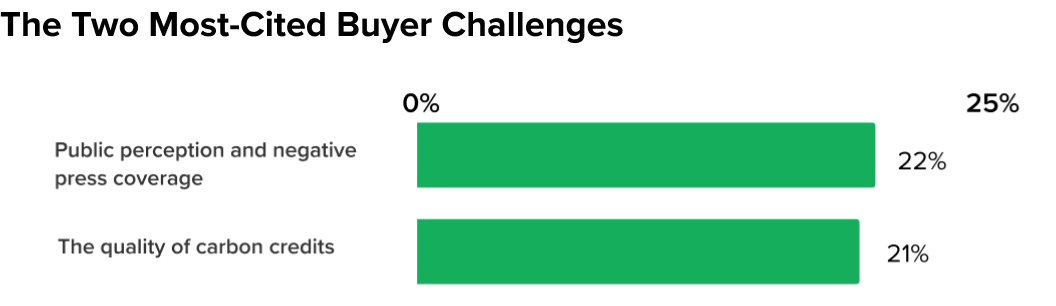

CCP eligibility will not eliminate the two biggest deterrents for buyers (Fig. 2), who expressed a significant interest in “complementary measures and tools” in a recent market survey².

Figure 2

For nearly 30% of companies, however, project due diligence is prohibitively expensive — as our Founder and CEO Chris Slater recently discovered³. By removing their barriers to market entry, insurance-wrapped credits could unlock additional deals.

Because Oka insures only the highest-quality projects, our coverage may also attract investors and lower your cost of capital.

Get a Quote In 72 Hours

Interested in the benefits of carbon insurance? Discover the value it could bring to your project as soon as this week. Just send us your project details, and we’ll send you a quote.

¹Trove Research, Potential Impact of the Core Carbon Principles (CCP) on the Global Carbon Credit Market, 2023 ²International Emissions Trading Association, GHG Market Sentiment Survey, 2023 ³Sylvera, The State of Carbon Credits, 2023