Carbon credit insurance introduces a prism of benefits to the voluntary carbon market (VCM): stronger risk assessments and clearer quality signals for carbon credits; better incentives and unit economics for project developers; and lighter due diligence, counterparty risk, and the financial and reputational burden borne by credit buyers, to name a few.

These advantages can ease long-tail risk and supercharge integrity and growth in the VCM. But not all insurance is created equal, just like the credits it protects. For carbon credit insurance to meet its full potential—minimizing risk and benefitting every player across the value chain systematically—it cannot be self-selected. It must be embedded.

The Benefits of Embedded Insurance

As with all insurance, expected underwriting losses are minimized when the entire pool of assets is insured rather than individually and based on asset-owner decisions. If customers choose insurance from a set of options offered by different providers—with options based on their expected probability of needing these services—it could create an adverse selection problem, which is one of the largest sources of inefficiency in insurance today.

In this scenario, individuals who expect higher costs prefer insurance contracts with higher coverages than those who prefer lower costs. Extremely low-risk individuals, or individuals with extremely predictable risks, often choose to self-insure and opt out of the market. This is particularly concerning in carbon markets, where credits have highly heterogeneous risk profiles.

Insurance should be embedded into all carbon credits of sufficient quality to avoid a scenario where only riskier credits are insured and costs rise on adverse selection.

Demand for Carbon Credit Insurance

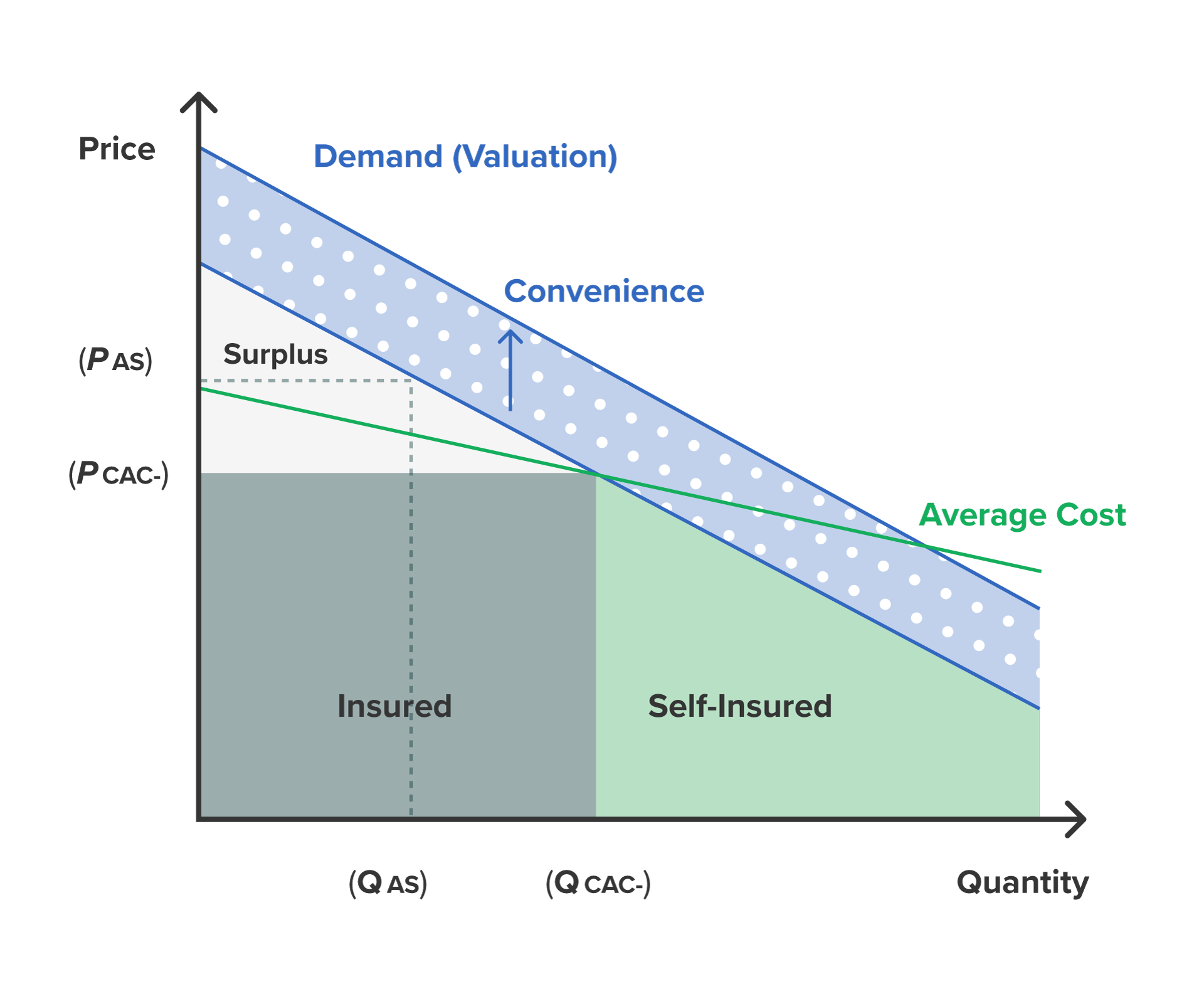

Corporate buyers are prone to the same biases that influence human decision-making in other walks of life. Nudge theory—a well-researched concept in behavioral economics—tells us that we make convenient decisions more easily. Nudge theory is relevant to historically underinsured markets generally and to the VCM specifically.

Today, the process of buying carbon credits is laborious. Seeking insurance is an additional complication. Search costs reduce insurance demand because they are effectively a tax on customer time or convenience. The value of the insurance to the customer must, therefore, exceed not only the premium itself but also the convenience cost. Embedding insurance eliminates search costs because the buyer no longer needs to search for insurance policies separately. It is particularly important in new insurance markets, where most customers are undereducated about the underlying asset risks. In the case of the VCM, for instance, embedding insurance at the point of purchase provides an important educational opportunity.

Embedding insurance at the point of carbon credit purchase also addresses the adverse selection problem by lowering the insurer’s portfolio risk and the customer’s premium. If a credit buyer had to search for insurance in a separate process from that of the credit transaction, for instance, they would be incentivized to do so only if they believed their credits had a high risk of exposure—or if they were extremely risk averse. Embedding insurance at the point of purchase expands the potential insurance pool to a broader market and captures customers who would not have otherwise searched for insurance.

Adding these lower-risk customers to the insurer’s pool decreases the average insurance cost and drives down the price charged to customers. This creates a virtuous cycle, incrementally lowering the insurance premium and making insurance financially viable for a larger pool of insureds. Over time, this would increase the demand for insurance per se and the demand for credits, as the widespread presence of insurance would increase market confidence in the VCM.

Fig 1: Embedding insurance in the carbon credit sale cycle shifts up the demand curve for insurance and carbon credits.

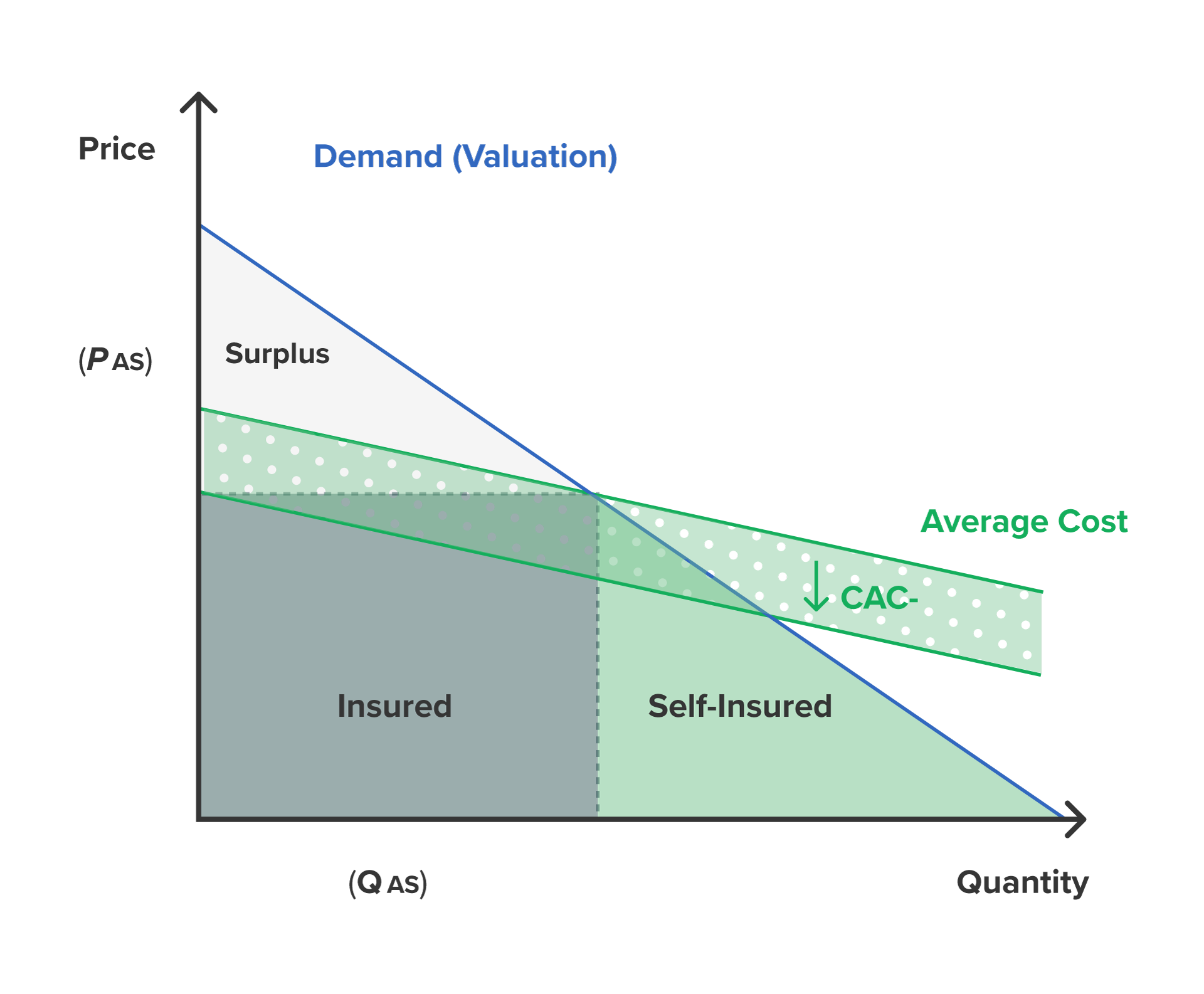

Supply of Carbon Credit Insurance

By pairing the sale of the credit with the insurance processes, embedding could drastically reduce premiums. For example, auto insurance increases premiums by 158% due to customer acquisition costs (CACs) alone. By decreasing CACs, embedding insurance at the point of purchase leads to a downward shift of the average total cost curve and, therefore, a downward shift of the supply curve. The marginal cost associated with these new customers is lower than the average total cost at the original equilibrium because the new customer has a lower risk profile. As a result, customers across all risk profiles can be insured at the willingness-to-pay of the incremental, lower-risk customer. This makes both the higher- and lower-risk customers better off.

Embedded insurance increases the demand for insurance and could also increase the demand for actual carbon credits. In 2023, the VCM endured several media scandals related to credit underperformance. This had a negative impact on confidence and trust in the VCM. Notwithstanding best efforts by buyers during their due diligence processes, credits are unavoidably exposed to risks. Insurance provides an additional layer of assurance that permits buyers to stand by their offsetting claims—even if a risk materializes.

Embedding insurance in the carbon credit sale cycle shifts down the supply curve for insurance and carbon credits.

Social Welfare and Market Expansion

Taken together, the supply and demand dynamics associated with embedded insurance will minimize the costs associated with carbon credit insurance. The credit buyer gets coverage faster and at a lower price, the insurer has access to a wider, lower-risk customer pool, and the wider community benefits from lower-risk exposure. Therefore, embedding insurance in the carbon credit purchase process could have a net-positive social impact.

Finally, and perhaps most importantly, embedding insurance in the carbon credit sale cycle can also incentivize the growth of the VCM itself.

For the VCM to reach gigatone scale and be environmentally meaningful, we must ensure that the risks associated with a credit are reflected in its price while reducing buyer exposure. If insurance were to be a default feature of the transaction process, it would create trust in carbon credits and incentivize players currently opting out of the market to start buying credits and investing in new carbon technologies. This could reduce price, risk, and buyer due diligence, bringing much-needed liquidity to an important market with enormous potential.