CORSIA Rubber Hits the Runway

The central focus of my last update, Corresponding Adjustment Protect™ has attracted commensurate market interest since our announcement in June. Unveiled alongside our partnership with leading cookstove developer DelAgua, the launch was covered by Carbon Herald, Sustainable Insurer, Carbon Pulse, and Quantum Commodity Intelligence, among others, and sparked a high volume of conversations with curious developers looking to access — and better understand — CORSIA. To help our customers make sense of this fast-moving market and its rapidly evolving rules, we published a series of three blogs addressing their biggest questions:- First: What does CORSIA mean for developers in the voluntary carbon market (VCM)? Which guarantees are required by its registries?

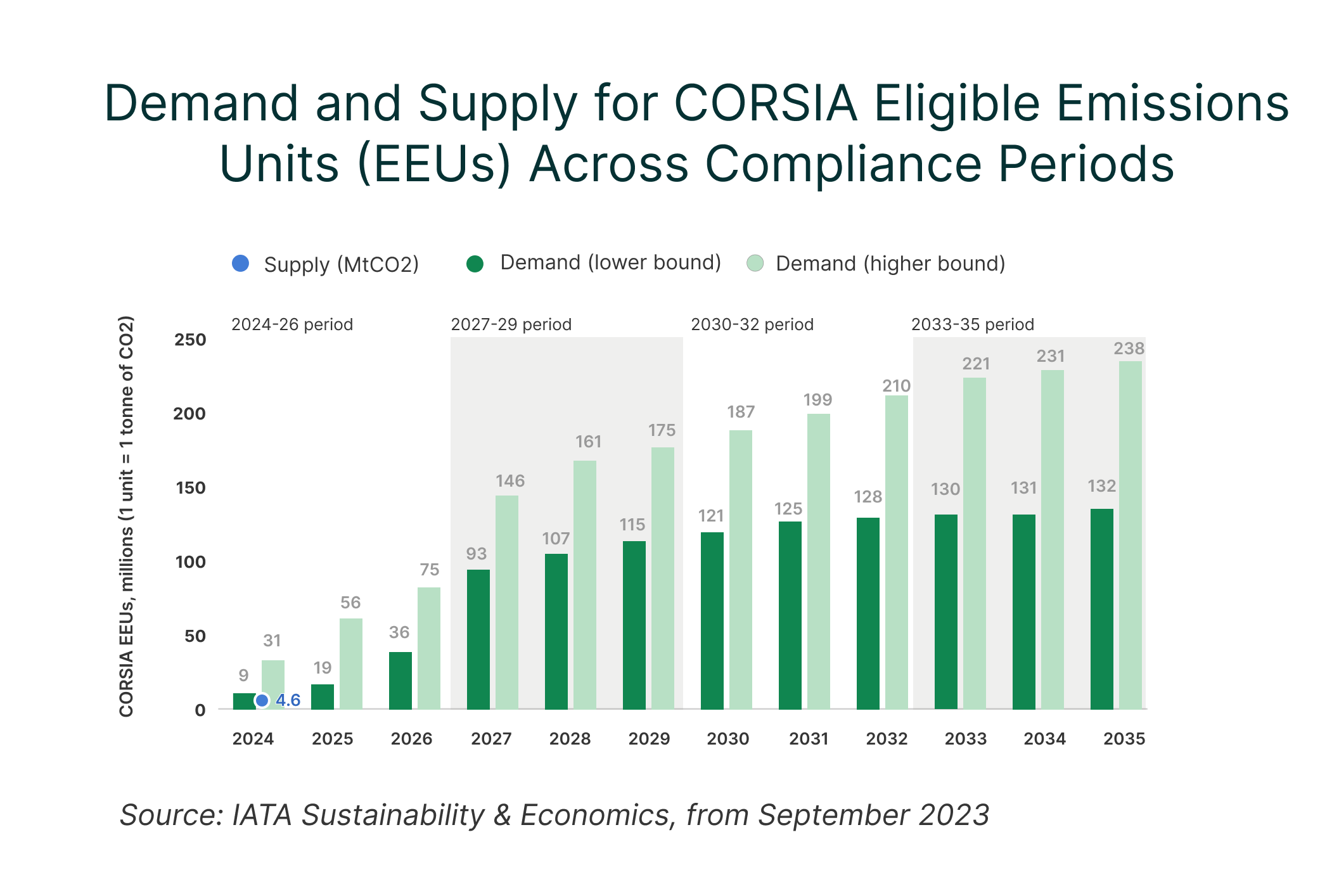

- Second: Why should developers be selling into CORSIA, particularly against the current market backdrop? Where do they stand to benefit?

- Third: Who can access CORSIA, and by when? How could Corresponding Adjustment Protect™ help you get there faster?

ICYMI…

- In May, we welcomed David Antonioli to our advisory board. His feet now firmly under the table, we recently sat down with the industry pioneer and former Verra CEO to discuss his ambitious new vision for carbon markets and the infrastructure required to bring it to life — insurance in particular. Read the full interview.

- In July, we formally unveiled our strategic partnership with Socotra, the leading modern policy administration system. The collaboration harnesses our agile team and advanced AI capabilities, alongside Socotra’s innovative technology, to insure carbon markets and scale climate solutions. Read the press release.

- In September, I was featured on the Marsh “Risk in Context” podcast with Amy Barnes, Head of Climate and Sustainability Strategy and Ryan Bond, Head of Insurance Innovation for Climate and Sustainability for Marsh. Listen here.

In New York for Climate Week NYC 2024? So are we. Get in touch to schedule a coffee or chat with Zachary or me. We’ll also be speaking and/or attending at the following events, and would love to see you there.

- Xpansiv Climate Week Summit

- ClimateImpact Carbon Accounting & Credits Workshop

- NY Climate Week Methane Reduction Intensive

- Navigating Voluntary Carbon Markets: Ensuring Integrity and Maximizing ROI

- Financial Times Climate Week NYC

- Global Carbon Market Utility Roundtables

Q4 2024: Future Speaking Events