Carbon credits are a central pillar of many firms’ decarbonization strategies as they offset residual emissions that cannot be removed or reduced. Nonetheless, they are exposed to several risks with dangerous implications for corporate buyers and the environment.

There is a long and unregulated road from creation to retirement. At any point in the value chain, carbon credits can be reversed, invalidated, downgraded, double-counted, or even stolen. Should any of those events materialize, the credit buyer would find that they have emitted more carbon than they claimed.

Carbon Credit Lifecycle

Given increasing stakeholder and regulatory scrutiny, the environmental damage could have serious reputational and financial repercussions for your business. In this article, I outline the risks to which you need to stay alert.

The 12 risks facing your carbon credits

A carbon credit might be invalidated due to the following reasons:

1. Reversal: A project may be destroyed by a flood, fire, storm, drought, or other catastrophic natural event. Alternatively, it might be decimated by human activities such as illegal logging or poor forestry management. If a project goes up in flames, so too does the value of its associated carbon credits.

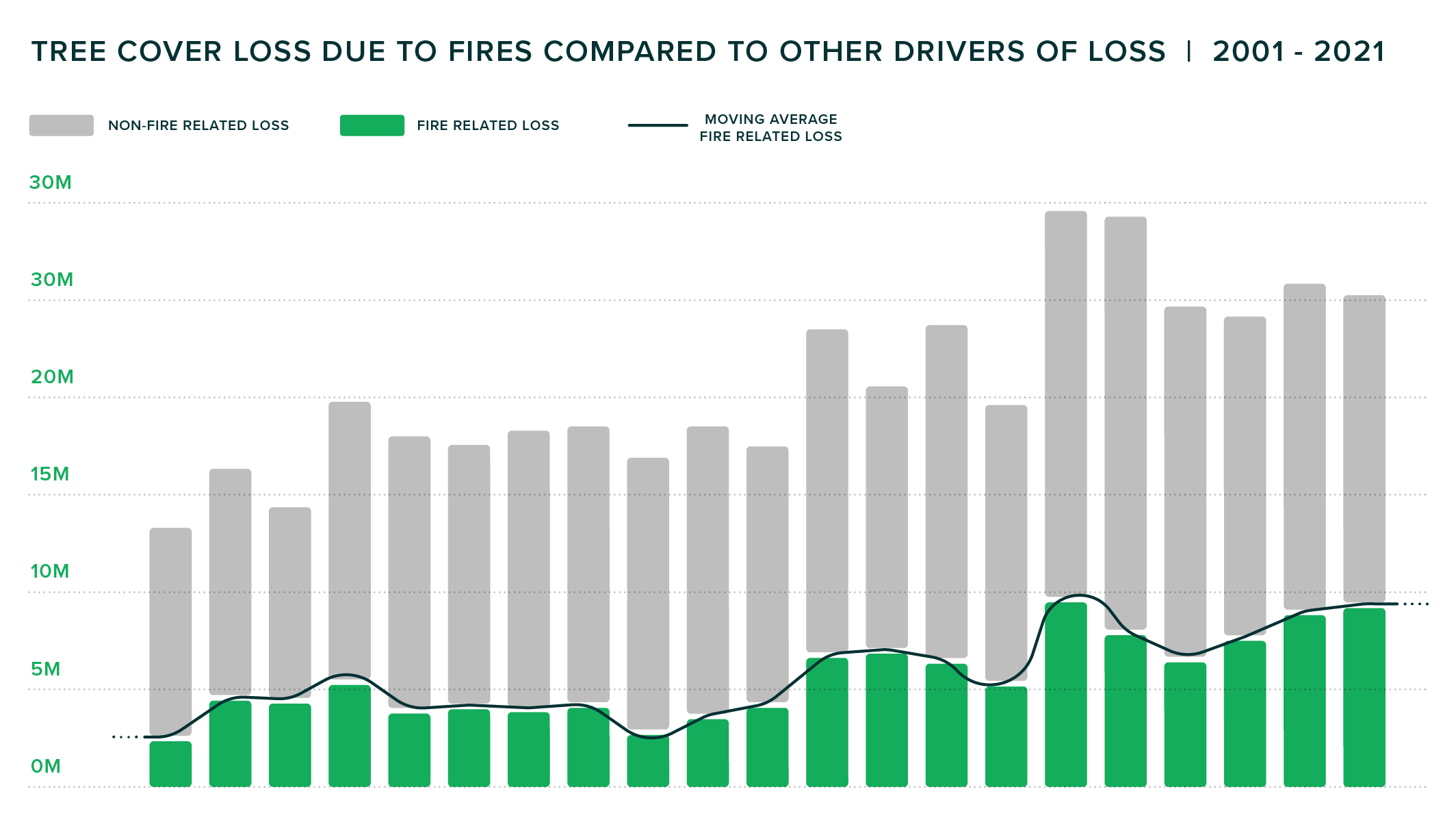

Reversal is a growing risk because climate change has exacerbated the frequency, length, and severity of catastrophe events. Earlier melting of snowpacks results in water scarcity during hot summer conditions, which contributes to an increase in wildfire risk and droughts. Forest fires caused 3 million more hectares (7.4 million acres) of tree cover loss in 2021 compared to 2001. This amounts to an area larger than Belgium.

Source: World Resources Institute

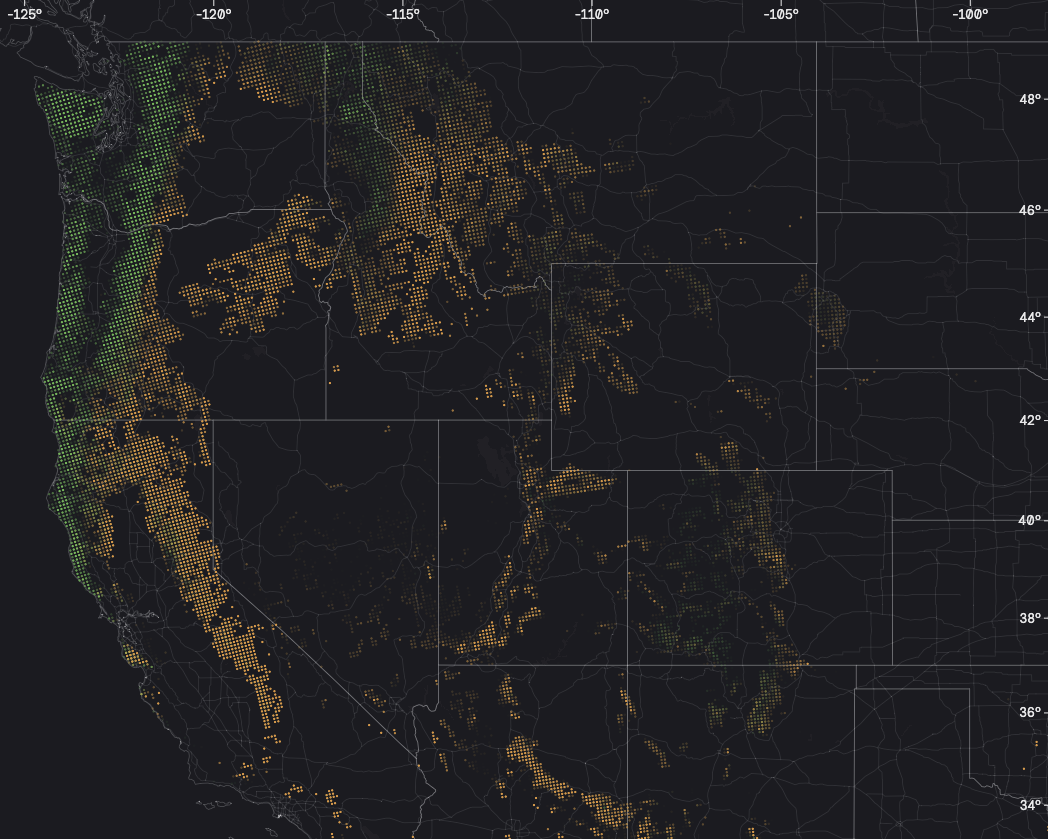

2020

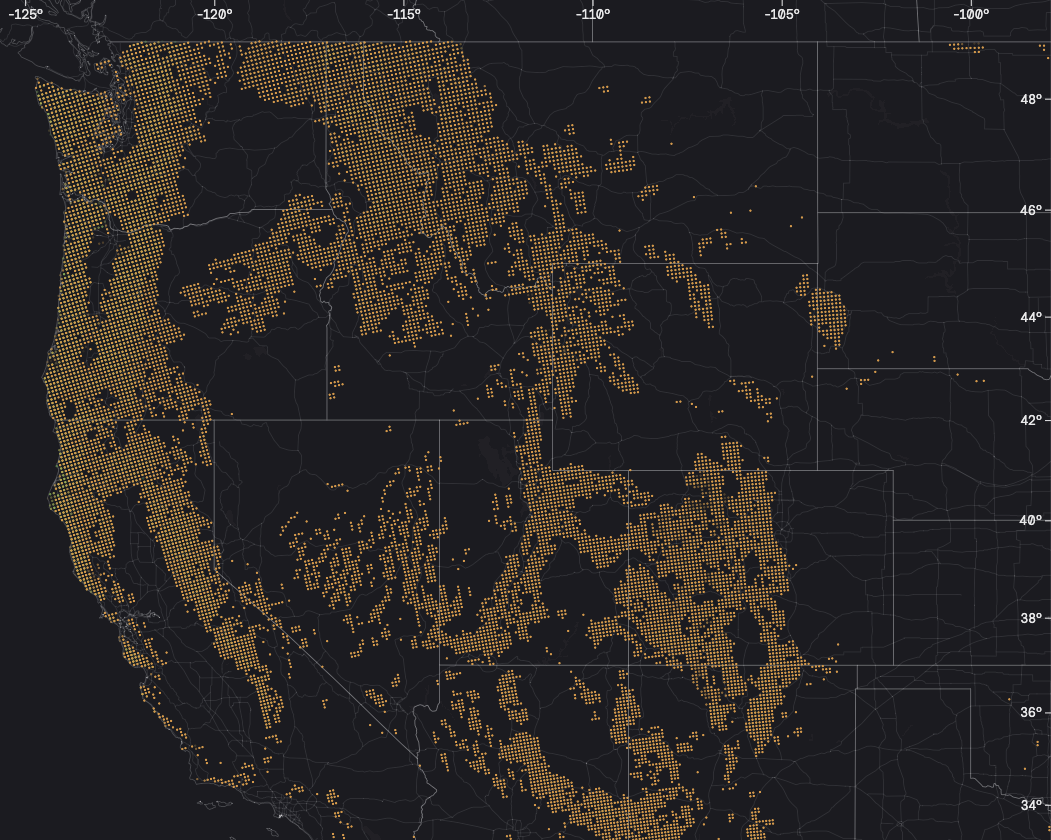

2090

2. Over-crediting: Credits are subject to oversight by registries and verifiers, which use detailed methodologies to establish the number of credits generated by a project each year. If scientific advances necessitate a change to the methodology, or if flaws are discovered in the baseline used to measure carbon removal, then previously issued credits are invalidated.

A recent study revealed that 29.4% of credits analyzed under California’s forest carbon offsets program were found to be over-credited because they were being compared to regional carbon averages.

3. Non-additionality: To be deemed ‘additional’ by a registry, a carbon credit must remove greenhouse gasses from the atmosphere that would not have been removed had the associated project not existed. It is not always a given: This Nature Communications article maps ‘investable’ carbon stocks based on their likely additionality. New information can prompt a registry to change its assessment of a credit.

4. Credit downgrades: Rating agencies provide a score that represents the probability that a carbon credit has removed a ton of greenhouse gasses from the atmosphere. If, however, negative new information emerges that suggests the underlying project is less robust than has been claimed, the agency may be forced to downgrade its rating.

5. Double-issuance and double-claiming: So-called double-counting can happen in one of two ways. In the first instance, more than one project claims the same underlying carbon reduction. In the second, more than one buyer counts the carbon removal to their respective decarbonization goals. If it comes to light, either example of poor accounting will lead to credit invalidation.

6. Project fraud: Related to many of the aforementioned risks, project fraud refers to any deliberate misrepresentation of carbon removal. In addition to exaggerating the carbon reduction achieved by an existing project, a developer may stake claim to projects that simply do not exist. Project fraud can also refer to manipulation at the point of monitoring, reporting, and verification.

The voluntary carbon market is famously unregulated. In addition to invalidation, a carbon credit is susceptible to nefarious and accidental loss at multiple points across the value chain:

1. Seller fraud: On top of project fraud, credits are susceptible to fraud at the point of sale or trade. For instance, an unscrupulous seller may retire carbon credits on behalf of multiple customers, misrepresent the quality or quantity of credits sold, or sell credits that had already been canceled.

2. Theft or loss: Typically stored in central registries, carbon credits can be traded or exchanged for monetary value. This makes them vulnerable to theft or loss. Hackers could target registries with a view to transferring or selling credits illegally, while accidental losses could also occur due to technical failures on the part of registries or trading platforms.

3. Cyber-attack: Related to digital theft, carbon credits are increasingly vulnerable to ransomware, phishing, and cyber-attack by criminals. Serving as a stark warning of what could happen in voluntary carbon markets, compliance carbon markets have been victim to devastating cyber-attacks by malicious scammers, which have, at times, forced the closure of centralized registries.

Finally, because nature-based solutions are uniquely dependent on regional conditions, carbon credits are inherently vulnerable to geopolitical risks. These include:

1. Expropriation of land: Changes to government policy or land ownership laws, whether that takes the form of forced seizure, nationalization, or appropriation, may force projects out of private ownership. In such circumstances, the projects and their associated credits become invalidated.

2. Loss of rights: In more direct ways, government intervention can undermine the value of carbon credits. By putting a hold on the export, sale, or retirement of credits, for example, new regulation can prevent market actors from exercising the credit — even if they sit outside its jurisdiction.

3. Political violence: On top of inflicting social devastation, politically motivated violence or war can destroy nature-based projects and invalidate the associated credit. Regional disruption can, moreover, have consequences for the project operations and prevent it from reaching retirement.

In my last article, I argued that carbon credits play a critical role in the transition to net zero. Notwithstanding their importance, however, the long list of risks to which they are vulnerable proves they are no magic bullet. Today, these risks sit with end buyers. In the event of non-performance, the financial and reputational, not to mention environmental, consequences can be grave. That is no way to guarantee market integrity.

At Oka, The Carbon Insurance Company™, we are responding with a suite of insurance products that will protect your carbon credit investments and ensure the veracity of your offsetting claims. Our first product, Carbon Protect™, protects your carbon credits against a list of perils, replacing or augmenting them when needed to ensure that your climate commitments are honored.

To date, buyers seeking to de-risk their carbon credits have turned to buffer pools, which bear a number of unique disadvantages. In my next article, I will explain why and how insurance is the better solution.