Protect Your Transition to Net Zero

Carbon credits are a critical component of your decarbonization strategy, but they carry risk.

Oka’s™ carbon credit insurance mitigates that risk and provides much-needed assurances when investing in the voluntary carbon market (VCM).

Buy Insured Carbon Credits

Oka’s Insurance Solution

Carbon Protect™

Carbon Protect provides you with financial compensation in the event of unforeseeable and unavoidable post-issuance risks, including invalidation and reversal, so you can de-risk your strategy, meet your targets, and settle claims quickly.

Security Through the Carbon Credit Lifecycle

Coverage for Post-Issuance Risks

Adverse Impacts

High-quality carbon credits come from projects that avoid social and environmental harms and comply with the project jurisdiction’s legal requirements. Should adverse impacts occur, the associated carbon credits could be invalidated.

Exclusive Claims

More than one project may claim rights to the same carbon being removed or another entity could count the carbon removed by your credit in its own carbon offset goals.

Human-Induced Activity

Negligent management practices, faulty carbon storage, project failure, land use changes, or unintended harvesting/logging may release previously removed or avoided emissions into the atmosphere.

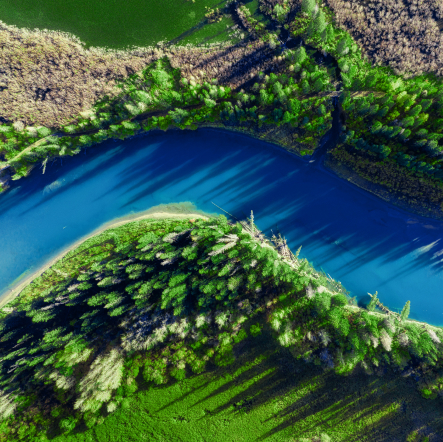

Natural Catastrophes

Floods, fires, storms, drought, or other catastrophic weather events may destroy all or part of a project and its carbon storing assets.

Non-Additionality

Your carbon credits must be deemed “additional” by a registry and/or verifiers. Emission reductions or removals from project activities are deemed additional if the mitigation activity would not have taken place in the absence of the added incentive created by the carbon credits. New information can come to light that causes the registry to change its assessment of your credits’ additionality leading to them being invalidated.

Over-Crediting

Your carbon credits are subject to central oversight by registries and verifiers. When it is discovered that a project has incorrectly quantified it’s baseline, carbon stock, emissions, and/or leakage then it may be determined the project is over-credited, i.e. it was issued more credits than actual tonnes of GHG removed or reduced, which may lead to the registry invalidating all or a portion of the issued credits.

Project Fraud

The carbon credit market is unregulated, putting your portfolio at risk of fraudulent activity in the form of intentional misrepresentations of the emission reductions achieved by a project.