Traditionally, December is the month for market reflections and industry projections. The fast-moving voluntary carbon market (VCM) warrants more frequent checkups. June concludes the first six months of 2023, which seems the perfect moment to take stock of the state of the market and draw a deep breath before diving into the year’s second half.

The Carbon Market Past

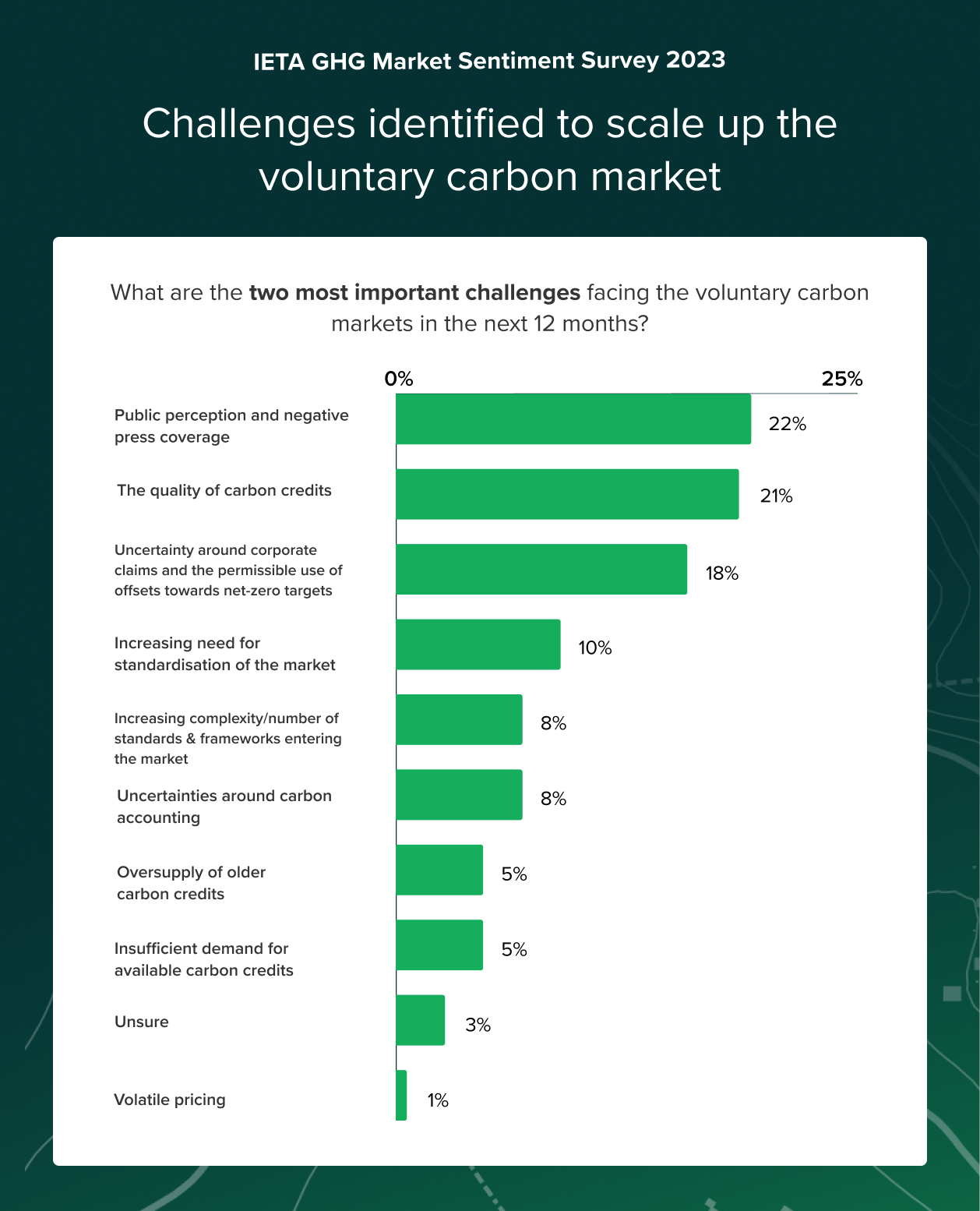

Last month, the World Bank published its annual review of carbon markets. The State and Trends of Carbon Pricing 2023 covers international progress in carbon markets (both compliance and voluntary), as well as their supporting frameworks, including the recently implemented Article 6 of the Paris Agreement and recently issued Core Carbon Principles (CCPs) by the Integrity Council for the Voluntary Carbon Market. The VCM has transformed since the first carbon pricing State and Trends report was published in 2014. Carbon markets, in general, are unrecognizable from those first explored by an earlier iteration of the report, published annually beginning in 2003, with the report’s focus shifted from markets to pricing in 2014. In just one decade, notes the World Bank, “ … voluntary action around carbon markets has proliferated as corporations have become the biggest source of demand for carbon credits.” Today, “voluntary demand from companies remains the primary driver of market activity.” Of the 196 million credits retired in registries in 2022, the vast majority represented voluntary demand. Notwithstanding the backdrop of major macroeconomic, geopolitical, and market-specific upheaval (latterly in the form of supply-chain bottlenecks), the World Bank anticipates “a decade of significant growth” paved by “new investors, financial products, technological platforms, and service providers” in the VCM. Its findings tally with those of the (likewise, just-released) GHG Market Sentiment Survey 2023. Canvassed by the International Emissions Trading Association (IETA) in partnership with PwC, market participants estimate the VCM will be worth $10-$40 billion by 2030. Tailwinds include surging corporate net-zero pledges, compliance obligations from markets that accept voluntary credits (such as CORSIA), and difficulty reducing hard-to-abate emissions from value chains. Can existing infrastructure cope with booming corporate demand? Yes, say 71% of survey respondents — though serious concerns remain about the quality of carbon credits available for offsetting.

Carbon Protect™

Carbon Protect™