Discover how Oka, The Carbon Insurance Company™ (Oka) worked with DelAgua to guarantee its CORSIA-eligible credits, providing the insurance solution that opened up access to airline buyers and a profitable new revenue stream.

The challenge

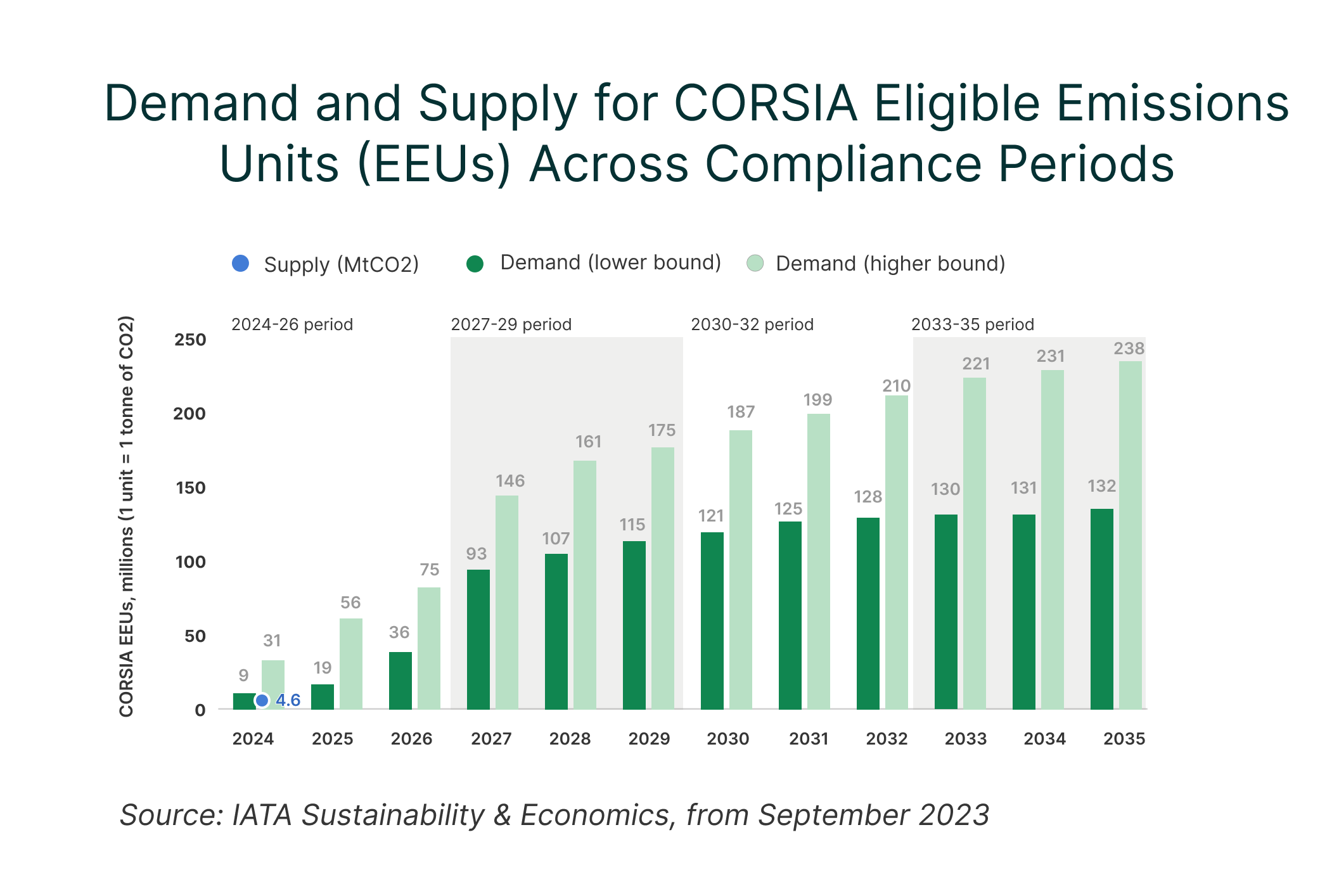

In October 2023, leading carbon project developer DelAgua, working in partnership for 12 years with the Government of Rwanda (GoR), became the first project developer to secure a Letter of Authorization (LoA) from the GoR. Being a first-mover comes with significant commercial advantages for developers in the supply-strapped CORSIA market (Fig. 1) but it also presents new challenges.

Potential airline buyers, carbon credit registries, and the International Civil Aviation Organization (ICAO) have all raised concerns about the risk of credits losing their CORSIA eligibility due to host governments reneging on the commitment made in their LoA. DelAgua, while having a long and trusted partnership with the GoR and complete confidence in the LoA, recognised that customers and the broader market were seeking additional security and reassurance

The solution

In March, DelAgua partnered with Oka to create a tailored insurance solution that would protect its credits against the risk of a failed corresponding adjustment and subsequent Article 6 revocation.

For DelAgua, insurance was the obvious answer to perceived risk. Not only does it insulate both developer and customer against financial and reputational fallout in the event of risk materializing, but insurance, specifically, is a “universally understood” marker of safety and quality that can be communicated easily to buyers, many of which are new to carbon markets.

And Oka was the obvious provider with which to partner. Oka is both a specialist carbon-market underwriter — meaning we have the expertise and flexibility required to develop innovative solutions, fast — and a Lloyd’s company. Backed by the world’s leading insurance market, our clients, and their customers, can also count on financial security and institutional scale.

Oka launched Corresponding Adjustment Protect™, underwritten by Lloyd’s syndicate Oka 1922, in mid-2024, with DelAgua the first developer to sell insurance-backed credits into the CORSIA market. The solution is underpinned by:

- Bespoke pricing: To model and price the risk of revocation in the absence of historical data, Oka worked closely with DelAgua and the Government of Rwanda, using unique data points to develop a tailored quote. Ratings and policy administration were also developed internally.

- Market validation: Oka consulted its extensive network of registries, associations, and market bodies to develop a best-in-class risk solution. Through industry collaboration, we delivered a policy that not only protects DelAgua and its customers against all ‘known unknowns’, but which also sets the standard for market authorization in the future.

- Secure coverage: The policy provides multi-year coverage against the risk of Article 6 revocation, carrying DelAgua and its customers from LoA issuance to BTR filing. And they can be confident in the policy: Beginning with its own capacity as a Lloyd’s insurer, Oka is also attracting additional capital from fellow Lloyd’s insurers via a lineslip.

“Our partnership with Oka… allows us to offer the security buyers are seeking alongside the high integrity and impact that differentiates DelAgua’s credits. I see Corresponding Adjustment Protect as an exciting innovation that will be a real catalyst for growth across the market.”

— Neil McDougall, Co-Founder & Chairman, DelAgua (Press Release)

The results

- Accelerated access: Upon reviewing the project and LoA, DelAgua received a quote in a matter of days to insure the world-first Article 6 credits for their customers.

- Commercial success: DelAgua sold a significant tranche of insurance-backed credits in 2024, making it one of the first developers to carve out CORSIA market share.

- Competitive advantage: Solidifying its first-mover status, DelAgua garnered media attention from Carbon Pulse, Sustainable Insurer, Malaysian Reserve, Clean Cooking Alliance, and more.

“We’ve already used the Oka policy on our biggest sale to date… The policy was superb for us and allowed us to go and underwrite the risk. Buyers want that extra level of protection, and insurance has helped push the sale over the line.”

— Euan McDougall, COO, DelAgua (Carbon Pulse)

Carbon Protect™

Carbon Protect™